How Candy Giants Conquered Halloween Through Storytelling, Strategy and Screen Time

Every Halloween, I’m reminded that chocolate isn’t just candy, it’s marketing. It tells stories, builds memories, and creates loyalty in ways few brands ever achieve. The 2025 Halloween season once again proved that lesson, with Hershey, Mars, Kinder, and Starburst turning sweetness into strategy. This was a competition for shelf space and a masterclass in how nostalgia, innovation, and digital storytelling combine to drive cultural dominance.

The 2025 Halloween season reinforced Hershey’s dominance in the U.S. candy market. With Reese’s, Kit Kat, and Almond Joy leading sales, the Hershey Company again claimed the top spot in Halloween candy sales, according to multiple industry surveys and retail reports. DoorDash and Instacart both ranked Reese’s Peanut Butter Cups as America’s favorite Halloween treat, echoing findings from USA Today, Real Simple, and The Washington Times. As one DoorDash spokesperson noted, “Reese’s reign is as consistent as pumpkin spice—it’s what Americans reach for every October.”

For communicators, Hershey’s approach illustrates the power of brand continuity. Rather than chasing seasonal gimmicks, Hershey leans on established emotional associations, nostalgia, trust, and familiarity, across decades of consistent advertising and packaging.

Mars Brand Performance and Product Innovation

Mars, Inc. sustained its position as Hershey’s most formidable rival, with M&M’s ranking second nationally and Snickers and Twix rounding out the top five. Mars’ Halloween strategy began early, launching candy shipments on July 5 and producing 30 million M&M’s daily from its Topeka plant. This operational foresight positioned Mars to dominate early shelf space, while limited-edition launches like Snickers Pumpkins, Twix Ghoulish Green, and M&M’s Pumpkin Pie flavor captured consumer curiosity.

According to Brand Eating, Mars’ seasonal rollout “delivers on excitement through flavor and form, connecting with fans before competitors even join the game.” The brand also leveraged cross-holiday marketing with its “Hallowmas” Twix campaign, bridging Halloween and Christmas themes for sustained visibility and engagement.

For communicators, Mars demonstrates innovation as narrative and each product variation tells a story of surprise, playfulness, and cultural relevance.

Starburst Market Position and Regional Preferences

Starburst, part of the Mars portfolio, showed strong regional resonance, emerging as the most popular candy in states like Texas, Georgia, and North Dakota. While ranking 13th nationally, its continued inclusion in variety packs bolstered presence at scale. Its “Opal Fruits” heritage and classic flavor palette remain key brand assets.

As RGJ.com observed, “Starburst’s authenticity—the simplicity of flavor and color—is its nostalgia play.” For communicators, that simplicity underscores a critical truth: clarity outperforms complexity when managing legacy brand messaging.

Kinder and Ferrero Enter the Mainstream

Kinder, under Ferrero’s North American umbrella, took a strategic detour from traditional Halloween advertising in 2025. Instead, Ferrero invested over $100 million in sports marketing, including its first Super Bowl spot for Kinder Bueno and upcoming global soccer campaigns. The company called it “Ferrero’s largest global marketing commitment to date,” per New Jersey Business Magazine.

By focusing on long-term brand awareness over seasonal promotions, Kinder’s shift highlights how brand storytelling can transcend holiday cycles—a lesson for communicators navigating resource allocation in saturated marketing moments.

Pricing Pressures and Retail Promotions

Candy inflation bit hard this year. Cocoa prices climbed to record levels, 76% higher than the decade average, according to Yahoo! News and Dallas News. Hershey’s variety packs rose 22% year-over-year, while Mars and Reese’s prices increased 12% and 8%, respectively. Retailers fought back with discount strategies: Target offered Mars Wrigley 110-piece assortments at $14.99, and CVS ran buy-one-get-one promotions on Hershey’s bulk bags.

For communicators in CPG, this illustrates how pricing strategy and messaging are inseparable. Brand trust enables elasticity and consumers may accept higher costs if emotional and experiential value remain consistent.

The Candy Industry’s Media Pivot

According to new data from iSpot.tv, candy brands spent 37.5% less on TV advertising this October, dropping from 20 brands in 2024 to just 14 in 2025. Major names like Kinder and Starburst went dark on television, despite being top spenders last year. Instead, the action shifted online.

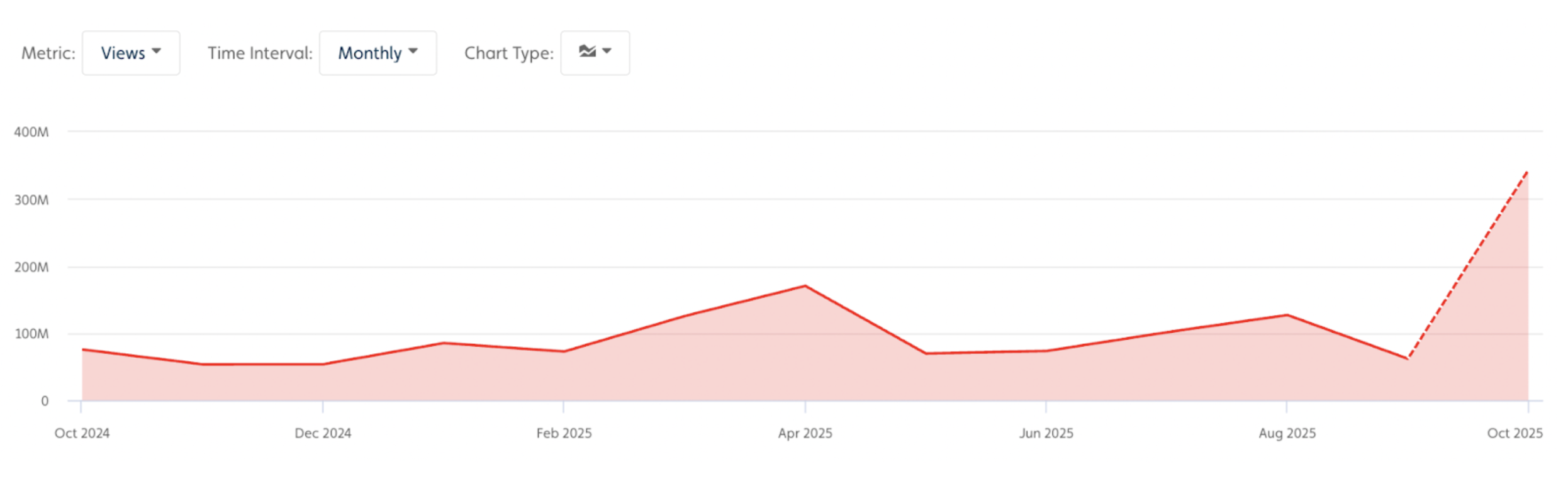

Tubular Labs data shows Hershey’s YouTube views jumped nearly fivefold year-over-year, soaring from 76 million to 343 million despite fewer uploads. Mars saw similar success, with views up fourfold to 240 million while cutting uploads by 75%. The key difference: vertical video.

By adapting traditional ad content into mobile-friendly, creator-style formats, these brands captured audiences where Halloween culture actually lives on social feeds. For communicators, this signals a new creative economy of attention, where storytelling agility matters more than sheer spend.

Campaign Storylines That Captured the Season

Media intelligence firm Truescope tracked standout campaigns shaping Halloween 2025:

Mars “Tails & Treating” campaign: A cross-category innovation combining human candy and pet treats, tapping into dual consumer passions of pets and Halloween.

M&M’s “Rescue BOOths”: Pop-up installations solving real consumer problems like last-minute candy shortages, blending service design and storytelling.

Skittles “Ghost Roommate”: Horror-themed episodic storytelling using short-form video to merge entertainment with brand identity.

Twix “Hallowmas”: Cross-seasonal marketing encouraging consumer participation through social challenges and giveaways.

As AdAge described, “This is probably the strongest Halloween season we’ve seen in years—brands are solving real problems, not just selling sugar.”

Communicators can take note: relevance now means solving for emotion and experience, not just awareness.

Market Shifts and Consumer Behavior

The candy aisle itself is changing. Non-chocolate sales are growing faster than chocolate, much to my chagrin, as gummy and fruit candies are rising with the cocoa prices spike. Media outlets have reported that chocolate sales rose just 0.4% year-over-year, while non-chocolate treats surged, signaling a shift in consumer affordability and taste preferences.

This trend reflects a broader lesson: market adaptation requires narrative adaptation. As consumers pivot toward new formats and flavors, brand storytelling must evolve to maintain excitement.

Marketers Takeaway

For marketers, this Halloween season proved that candy is more than sugar. Halloween is about storytelling.

Hershey reminded us that trust and nostalgia are the gold standard of brand equity. Mars showed how innovation and digital engagement can keep even legacy brands feeling fresh. Kinder played the long game with brand storytelling that extends far beyond the holiday season. Starburst stayed true to its colorful simplicity—and proved that sometimes, clarity really is king.

The brands that win the Halloween conversation are the ones that move from selling candy to owning culture, a strategy every communicator can adapt to their own world.

And if we’re being honest, the biggest takeaway for me? You can analyze data, trends, and creative all you want, but at the end of the day, I’ll still choose the strategy that comes wrapped in chocolate.