Streaming Wars Shift as YouTube Becomes Fall’s Real Battleground

For years the Streaming Wars were defined by subscriber gains, platform churn and the quarterly horse race that dominated investor calls. The fight has not disappeared, although the dynamics have changed. While subscriber competition has leveled off, a different contest has exploded on the open web. Major streaming services are driving record audiences on YouTube as they compete for fall attention with trailer drops and targeted promotional spikes.

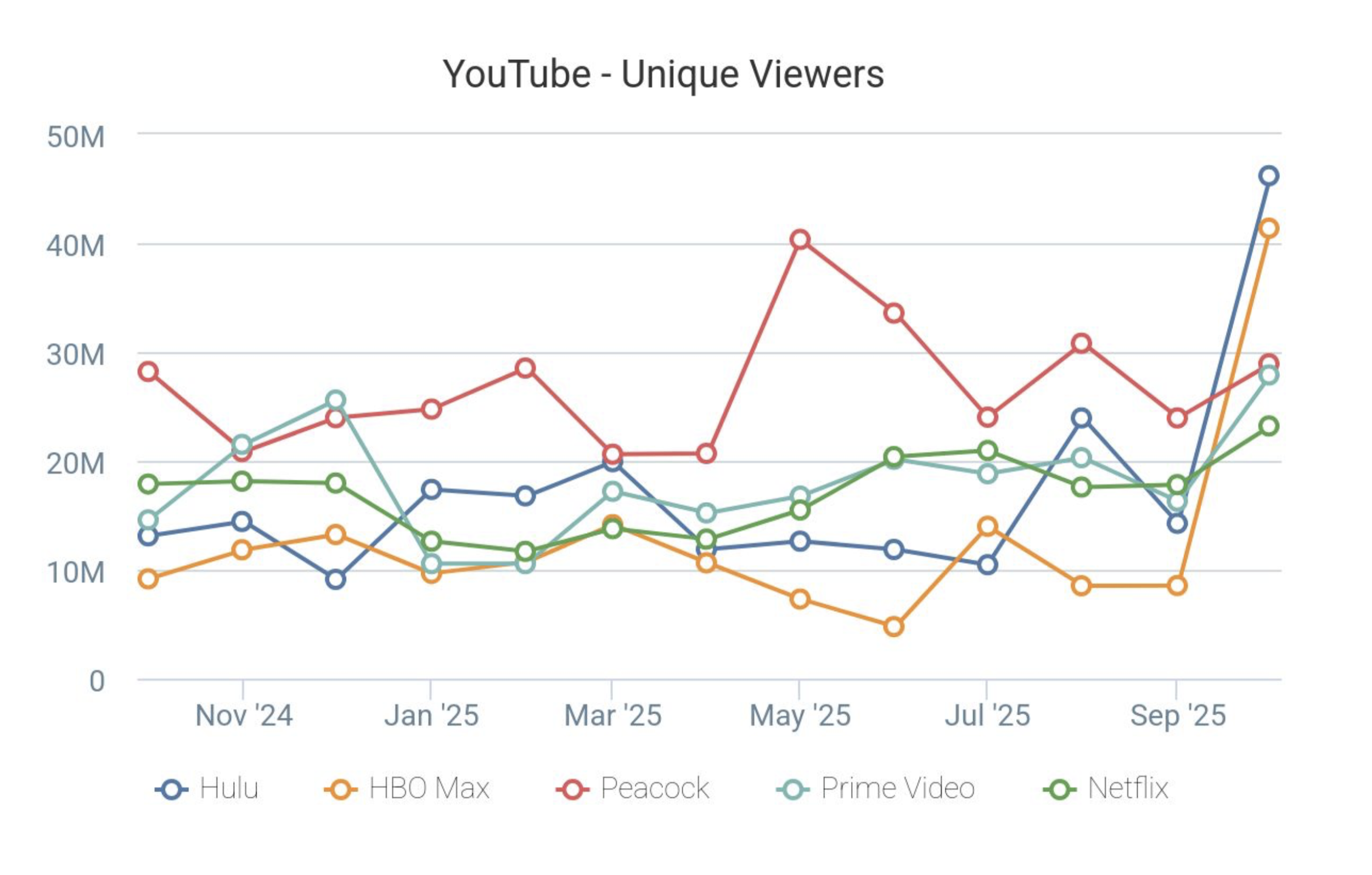

Tubular Labs data reveals a clear surge across the category. Hulu, HBO Max, Peacock, Prime Video and Netflix each posted substantial month over month growth in U.S. unique YouTube viewers, with nearly every service reaching a one year high. Hulu led the field in October with 46.2 million unique viewers, a 224 percent jump that lifted it to the No. 1 slot among all domestic media and entertainment companies. HBO Max ranked No. 3 with 41.4 million unique viewers, up 384 percent from September.

The chart provided by Tubular Labs captures the scale of the movement and the renewed relevance of YouTube in streaming strategy.

The reason for the spike is straightforward. As fall primetime schedules returned, platforms funneled their biggest titles into YouTube trailers to capture cultural momentum and reawaken lapsed interest. Hulu benefited from two Kardashian projects. Trailers for the new season of The Kardashians and All’s Fair, starring Kim Kardashian, delivered four of Hulu’s six top performing videos. HBO Max capitalized on Halloween and high demand for spooky programming with IT: Welcome to Derry content. Peacock and Prime Video leaned into sports, especially the NBA, and supplemented the slate with entertainment previews.

Communicators should note what has changed. Last fall, most streamers used YouTube trailers as passive engagement tools. This year, the same companies invested meaningful ad dollars to ensure distribution. The shift signals a new model for competing in a saturated subscription market. These companies now recognize that building buzz on YouTube influences both existing customers and households that may not be subscribed but remain culturally connected to the content.

This approach showcases a broader lesson for communicators. When subscription growth stabilizes, the battleground moves to awareness, association and share of conversation. YouTube provides reach, speed and a feedback loop that subscriber platforms cannot match on their own. Fall 2025 proved that the Streaming Wars are no longer confined to who signs up. The real contest now involves who owns attention at the precise moment audiences decide what to watch. Identifying where the energy naturally lives and amplifying it with precision becomes the performance advantage.

The renewed energy on YouTube also underscores the role of cultural timing. Halloween lifted horror titles. The NBA returned and lifted sports content. Social universes built around celebrities like Kim Kardashian delivered dependable spikes. These platforms did not simply post content. They posted content engineered for cultural waves. That is the playbook communicators should adopt across industries.

Success in this new era requires decoding how audiences flow across platforms and entering the conversation exactly when demand peaks. For streamers, YouTube has become the most efficient arena for that strategy, and the fall data confirms that the companies willing to invest in visibility are the ones shaping the narrative heading into 2026.