Closing the Gap on Activism Risk Through Investor Intelligence

US companies spent an average of $4.6 million defending against activist campaigns during the 2025 proxy season.

It’s therefore strategically valuable for investor relations (IR) professionals to be able to proactively detect, identify and track potential shareholder activists quickly and effectively.

Timely intelligence on changes to shareholder bases enables companies to better negotiate, deter or mitigate costly activist campaigns before they escalate.

Stock surveillance is one of the most important forms of intelligence monitoring. It provides near-real-time insights into trading behavior and serves as the ‘first line of defense’ in an emerging proxy fight.

Without investor intelligence, IR professionals must rely solely upon SEC Form 13F filings when planning investor outreach, roadshows and engagement strategies. The SEC requires 13F filings on institutional positions on a quarterly basis — and only for firms with more than $100 million in equity assets under management — but such investors do not need to disclose this information until 45 days after the calendar quarter ends.

As a result, an investor that acquires a 3% equity position in a company during the second half of October 2025 could file a 13F with the SEC as late as mid-February 2026.

That time lag means companies are less able to spot the accumulation of share positions and activist threats. This can lead to a significant loss of valuable time for the CEO and other company stakeholders seeking to understand their shareholder composition and be well prepared in advance of an activist scenario.

For IR, the ability to identify such potential threats earlier not only helps to mitigate risk and unexpected surprises for the C-suite and board, but also presents an opportunity to proactively develop strategies and messaging with investors before an activist discloses its position publicly.

Derivatives

The challenge becomes more pronounced when activists use derivatives to build exposure discreetly. Many hedge funds employ instruments such as swaps, OTC options and forward contracts to gain economic exposure to a company’s shares without directly owning the underlying securities.

The counterparty — typically an investment bank — is the named entity reporting the position on its 13F. As a result, activists can accumulate sizable economic interests but remain effectively anonymous. These derivative positions can later be converted into equity quickly, catching an issuer off-guard. Investor intelligence helps uncover those activists and close that dangerous visibility gap.

Advanced monitoring can enable IR professionals and their advisors to identify unexpected activity at custodial banks known to facilitate derivative-related transactions well before the quarterly disclosure cycles.

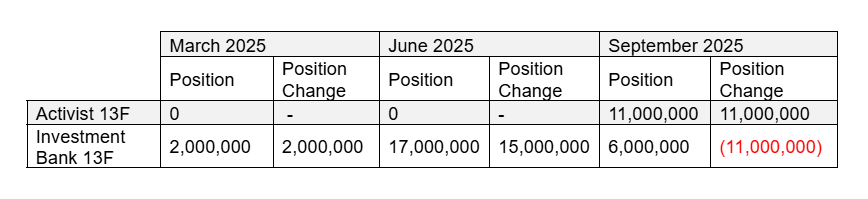

In the illustrative example below, public data did not reveal a potential activist’s equity position until the September 2025 13F filing submitted around mid-November 2025. This left a gap of nearly one and a half months between the last day of the calendar quarter (September 30, 2025) and the date when the activist disclosed its equity position (November 15, 2025). However, Investor intelligence would uncover such a derivative position in the second quarter of 2025.

Early detection of suspicious share accumulation enables the company’s core advisory group — including legal counsel, investment bankers, proxy solicitors and strategic communications partners — to begin preparing defensive strategies to support the board, C-Suite and IR.

Early preparation can also help mitigate potentially hostile and costly proxy fights, reduce uncertainty, improve negotiation outcomes, and decrease the likelihood that management will be forced into a reactive position. From an IR perspective, investor sentiment and outcomes during special situations are often driven by how prepared and proactive management appears to be.

Taking steps

Proactive stock surveillance should therefore be a standard element of any company’s investor relations strategy – not a step triggered after activism surfaces. As activism becomes more sophisticated and market dynamics accelerate, Investor Relations Officers (IROs) are increasingly expected to maintain continuous visibility into ownership changes and emerging risks.

Timely intelligence remains essential across the investor engagement lifecycle, but it is no longer sufficient on its own. IR teams are most effective when they pair market insight with two additional capabilities: sustained, structured engagement with investors and an internal system that centralizes communication, history and workflow.

Taken together, these three components — intelligence, engagement and integrated systems —form a continuous process that strengthens transparency, builds more resilient investor relationships and improves a company’s readiness to communicate effectively with both supportive and critical investors.

Using this combined approach, public companies can reduce the challenges and risks associated with potential activism and investor opposition.

For IROs, early detection and preparedness can be also central to maintaining strategic control over both investor engagement and messaging.