Cloud Computing Modernizes Finance and Reduces Emissions (INFOGRAPHIC)

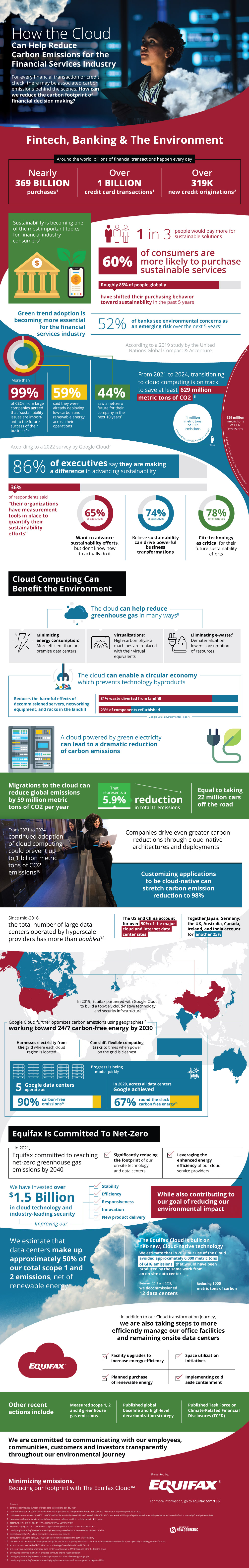

In 2022, most consumers are conscious of their individual effects on the environment. We’re looking for ways to conserve and ways to recycle, reuse, and to minimize our carbon footprint in the move toward the desired “net zero” status.

We can make a number of changes to our daily habits to work toward this goal, like reducing our use of plastic, using reusable grocery bags, eating more local and seasonal fruits and vegetables, and only buying what we need to avoid excess waste. However, one thing we may neglect to consider is that every single purchase we make throughout the day is also another contribution to carbon emissions.

One of the lessons we learned from the COVID pandemic is that the responsibility and effort to protect, heal, and promote safety falls on each individual and every single industry, from food to finance.

As it turns out, the financial industry can be a large contributor to global pollution and 52% of banks are seeing environmental concerns as a great risk within the next five years. Not only are financial organizations responsible for their part in climate change, but their consumers are also wanting them to use more sustainable processes, and many are willing to pay a little bit more in order to do business with sustainable organizations.

Currently, there are almost 370 billion purchases, and more than one billion credit card transactions every single day. Done traditionally, these transactions each may contribute to CO2 emissions across the globe. Fortunately, the traditional way is not the only way.

By transferring operations to the cloud, the financial industry can save millions of metric tons of CO2 emissions. In fact, cloud computing is set to be responsible for an emissions reduction of more than 629 million metric tons within the three years between 2021 and 2024.

Not only is cloud computing a sustainable mode of operations for the entire financial industry, but it helps the industry to stay relevant according to trends and desires of their consumer base. It also causes banks and other organizations to update their antiquated processes to function more efficiently and effectively in the modern economy.

Many processes within the finance industry need to be refurbished to and updated to stay on target to service the modern consumer. Transitioning to the cloud makes these long needed updates a reality, while helping the entire industry to uphold its global responsibility to do its part in reversing climate change.

About the Author:

Brian Wallace is the Founder and President of NowSourcing, an industry leading infographic design agency in Louisville, KY and Cincinnati, OH which works with companies ranging from startups to Fortune 500s. Brian runs #LinkedInLocal events, hosts the Next Action Podcast, and has been named a Google Small Business Adviser for 2016-present. Follow Brian Wallace on Linked In as well as Twitter.